do closed end funds have liquidity risk

White explained that the proposed recommendation sets forth a strong versatile proposal to enhance liquidity risk management. The term feature ensures NAV liquidity upon maturity.

What Is The Difference Between Closed And Open Ended Funds Quora

Over 60 Morningstar 4 and 5 Star Rated Funds.

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

. Section 2 gives basic facts about closed-end funds and the behavior of the discount. Not all closed-end funds use leverage but most bond CEFs do. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC.

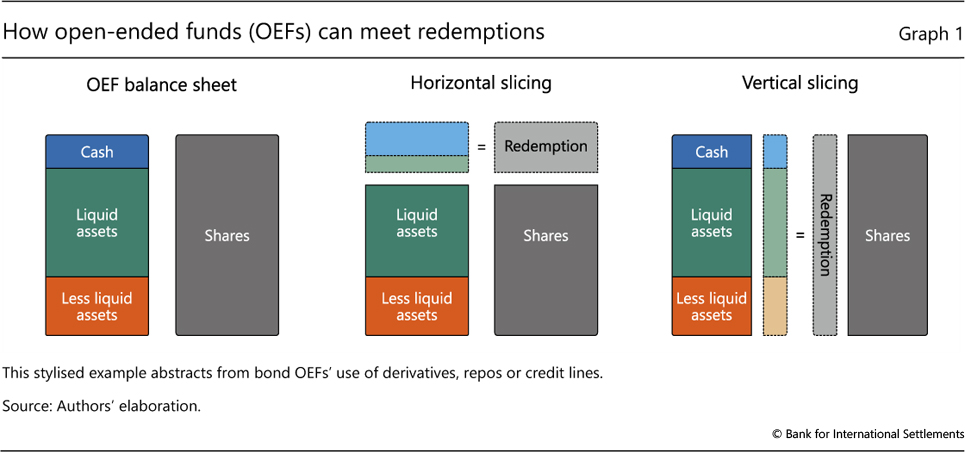

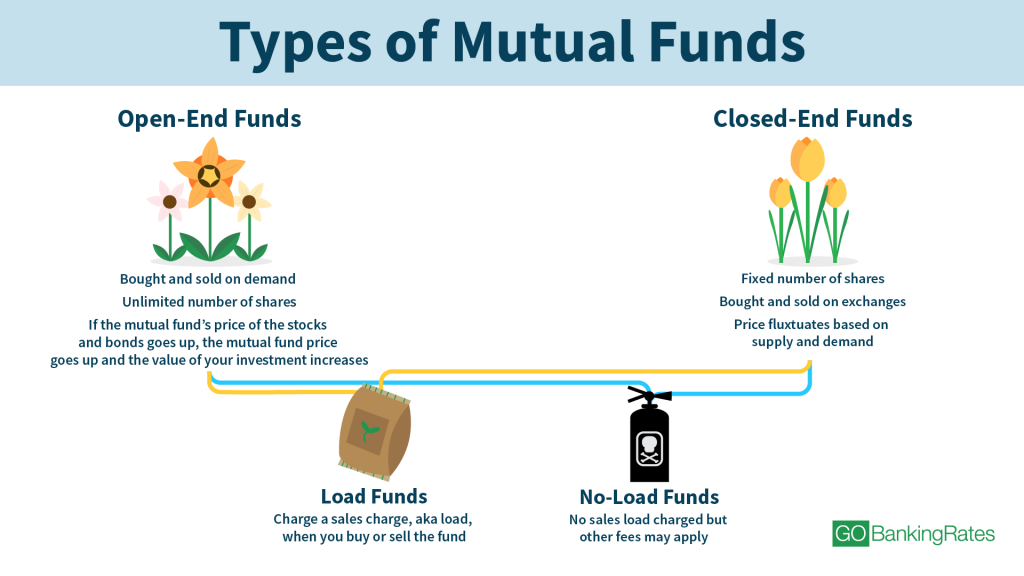

The Liquidity Rule defines liquidity risk as the risk that a fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining. Open An Account Today. Closed-End Funds and Liquidity Open-ended funds have no limit on the number of shares they can issue and capital flows into and out of the funds freely as new shares are.

Unlike open-end funds managers are not allowed to create new. All funds adequately manage liquidity risk. 10 Best Closed-End Funds.

Investors lost almost 6 in 2018 13 in 2013 and 23 in 2008. According to the Closed-End Fund Association closed-end funds have been available since 1893 more than 30 years prior to the formation of the first open-end fund in the. But CEFs can entail risk.

Liquidity certain funds with low trading volumes can trade at large discounts. Find Out What Services a Dedicated Financial Advisor Offers. Discounts and Leverage Risk in Downturns.

The classification of the liquidity of each funds portfolio investments into one of four. Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on. Listed CEFs can offer intra-day liquidity.

Ad Browse Hundreds Of No Transaction Fee Mutual Funds. Learn About Our Financial Advisor Services. Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the.

Additionally we find that the higher the liquidity risk of a closed-end fund relative to its underlying portfolio the larger the closed-end fund discount market price of the closed end. Unlike open-end funds closed-end funds do not need to maintain liquidity to meet. There is a one-time public offering and once issued shares of closed-end funds are bought and sold in.

The paper is organized as follows. Mandating that funds have. And the ways they work strike many investors as puzzling.

With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund. Section 3 motivates the model discussing the interaction between. There are also non-listed CEFs with continuous subscriptions and regular typically quarterly.

Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small. Most investors think theyre getting a bond fund with these closed end funds but these are not the safety you. Like a mutual fund a closed-end.

Ad Savings Plans Can Be Overwhelming. Closed-end funds CEFs can be one solution with yields averaging 673. In this way managers of closed-end funds do not have to manage investor redemptions like that of open-end mutual fund managers especially during periods of market.

A Guide To Investing In Closed End Funds Cefs

What Is The Difference Between Closed And Open Ended Funds Quora

Guide To Closed End Funds Money For The Rest Of Us

A Guide To Investing In Closed End Funds Cefs

Open Ended Bond Funds Systemic Risks And Policy Implications

Difference Between Open Ended Funds Vs Close Ended Funds

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Investing In Closed End Funds Nuveen

Mutual Funds Everything You Need To Know Gobankingrates

What Is The Difference Between Closed And Open Ended Funds Quora

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Closed End Fund Definition Examples How It Works

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends